Tim McGraw Entertainment Holdings

The Complete Platform Vision

Confidential Investment Presentation | January 2026

THE PLATFORM COUNTRY BUILT

30 years of Tim McGraw. $80M+ in catalog value. 80M albums sold.

Now: A diversified entertainment platform anchored by the most bankable name in country music.

31,750 tickets · SOLD OUT

Core platform only

Industry-realistic margins

10x EBITDA multiple

Single-Asset Celebrity Deals

One revenue stream. High key-person risk. No downside protection.

TMEH Platform

5 pillars. $80M catalog floor. Proven Music City Rodeo traction. Skydance partnership.

"What Dolly built in 40 years, Tim can build in 10 with strategic capital."

The Moment

Why Tim McGraw Is Building This Now

I'm not making that mistake."

1969 Mets, 1980 Phillies

Platform, not just performance

At 57, Tim is at the exact inflection point where Dolly Parton began building her empire.

This is the window. This is the moment.

TMEH Brand Architecture

One Platform, Five Pillars, Unified Value

MCR by TMEH, Draft House by TMEH

Diversified, synergistic

Drives blended returns

Protected downside

An Integrated Entertainment Platform

Six Revenue Engines with Western Culture at the Core

What Dolly Parton built over 40 years, Tim McGraw can build in 10 years with strategic capital and infrastructure.

McGraw Brand

NIL • Fragrance • Apparel • Spirits • Licensing

Y5: $35M Revenue

Down Home Entertainment

Film • TV • Broadway • Skydance 15% Owner

Y5: $55M Revenue

Music City Rodeo

Events • Festival • 5+ Markets Expansion

Y5: $83M Revenue

Draft House & Hospitality

Sports Bars • Titans Partnership • Hotels

Y5: $40M Revenue

EMCo Management

Artist Mgmt • Brand Partnerships • Touring

Y5: $19M Revenue

Music City Immersive

Future Optionality • Separate $200M Raise

NOT IN BASE CASE

Core Platform Y5: $178M | Y7 Base Case: $255M | $46M EBITDA (18%)

MCI is separate optionality with $180M+ potential if validated and funded separately

Tim McGraw

The Foundation of a $3B+ Platform

Music Career

- Recording Legacy: 100M+ records sold, one of the best-selling artists of all time

- Chart Dominance: 49 #1 singles across Billboard charts

- Awards: 3 Grammys, 14 ACMs, 11 CMAs, 10 AMAs

- Tours: Soul2Soul ($141M) - highest-grossing country tour ever

- Catalogue Value: $80-100M+ (appreciating asset)

Entertainment Empire

- Film: The Blind Side, 1883 (Paramount+), Country Strong — $1B+ combined box office

- Production: Down Home Entertainment (Skydance 15% partner)

- Management: EMCo - managing roster of major country artists

- Live Events: Music City Rodeo (Year 1: 31,750 sold out)

- Brand: NIL, licensing, endorsements - largely untapped

Why Tim McGraw?

30+ years of brand equity with no systematic monetization.

At 57 — the exact age Dolly Parton began accelerating her empire — Tim is ready to build.

$80-100M catalogue provides downside floor. Platform provides unlimited upside.

Year Zero: What You're Buying Today

Hard Asset Floor + Proven Revenue + Infrastructure Upside

This is NOT a venture bet. You are acquiring proven assets with a hard floor value and building infrastructure on top - the same approach that turned the Dodgers from $2.1B to $7.7B.

Hard Asset Floor (Day 1)

| Music Catalog | $80-100M |

| → 16-18x NPS multiples, liquid market | |

| EMCo Management | $15-20M |

| → 25-year track record, existing cash flow | |

| NIL/Licensing Revenue | $6-8M/year |

| → 70% margins, existing contracts | |

| Protected Floor Value | $100-130M |

Proven Revenue (Year 1)

| MCR Nashville | $8.2M (actual) |

| → 31,750 sold out, $258/attendee | |

| Down Home Film | Greenlit |

| → Skydance (15% owner) + Paramount | |

| EMCo + Catalog | $10M/year |

| → Steady, proven income stream | |

| Year 1 Revenue | $28M (actual) |

The Dodgers Playbook

$2.1B → $7.7B

Dodgers appreciation (12 years)

Hard assets + infrastructure buildout

$100M → $460M+

TMEH base case (7 years)

Same playbook, entertainment assets

Patient Capital

Not venture-style growth

Yield + appreciation model

Why Invest Now

Platform scales beyond any single individual

Same age Dolly accelerated

$11.2B spending (2024)

Catalog + EMCo value

David Ellison partner

What Scales Without Tim

- Down Home: Content creates perpetual royalties

- MCR: Brand replicates to new markets

- Draft House: Scalable venue concept

- Catalog: Appreciating asset, passive income

Competitive Moat

- Artist Access: Relationships with every major country artist

- Content: Skydance 15% owner + Paramount distribution

- Venues: Titans partnership + stadium district

- Brand: 100M records, 49 #1s, trusted household name

Nashville Visitor Growth (2014-2024)

Source: Nashville Convention & Visitors Corp. $11.2B visitor spending in 2024.

$300M builds the platform. $460M+ base case value by Y7.

Artist-Led Platform Architecture

Lessons from Dolly, Scaled with Institutional Capital

Dolly Parton Empire

| Dollywood Theme Park | $200M+/year |

| Dolly's Stampede Dinner Shows | $50M+/year |

| Licensing & Products | $100M+/year |

| Music Catalog | $350M+ value |

| Film/TV (Netflix, etc.) | Ongoing |

| DreamMore Resort | Hotels |

| Total Enterprise Value | $700M+ |

Built over 40 years starting at age 40

Tim McGraw Equivalent

| MCR Events + Festival | $90M/year (Y7) |

| Draft House (2 locations) | $35M/year (Y7) |

| McGraw Lifestyle/NIL | $58M/year (Y7) |

| Music Catalog | $80-100M value |

| Down Home (Skydance 15% partner) | $50M/year (Y7) |

| EMCo Management | $22M/year (Y7) |

| Base Case Platform Value | $460M+ (Y7) |

| + MCI (if built separately) | $1.8B+ potential |

Built in 7 years with strategic capital

The Tim McGraw Advantage

Down Home Entertainment

Skydance Media Partnership | 15% Strategic Owner

David Ellison (CEO of Paramount/Skydance) is a Down Home partner.

Skydance owns 15% of Down Home with Paramount distribution + production infrastructure.

Why This Matters: David Ellison (CEO, Paramount/Skydance) provides institutional entertainment credibility and distribution infrastructure.

Active Production Slate

| Project | Type | Status |

|---|---|---|

| Feature Film | Feature | GREENLIT |

| NFL Nashville Show | Series | In Development |

| Western Limited Series | Premium TV | In Development |

| Multiple TV Projects | Series | In Development |

| MCR Content | Reality/Doc | Cowboy Channel |

Broadway & Theatrical

| Project | Model | Status |

|---|---|---|

| "All My Rowdy Friends" | Broadway Musical | IN DEVELOPMENT |

| Tim McGraw Jukebox Musical | Mamma Mia model | Y4-5 |

| MCR Touring Show | Rodeo theatrical | Y3+ |

Broadway Economics:

- Hit jukebox musical: $50-100M+ over run

- Touring production: $20-40M annually

- Licensing/rights: Ongoing revenue

Content Revenue Projection

| Category | Y1 | Y3 | Y5 | Y7 |

|---|---|---|---|---|

| Film/TV Productions | $2M | $15M | $30M | $50M |

| Broadway/Theatrical | $0 | $2M | $10M | $20M |

| Licensing/Sync | $2M | $5M | $10M | $8M |

| Cowboy Channel Content | $1M | $3M | $5M | $2M |

| Total Down Home | $5M | $25M | $55M | $80M |

Music City Rodeo Events

National Expansion Strategy

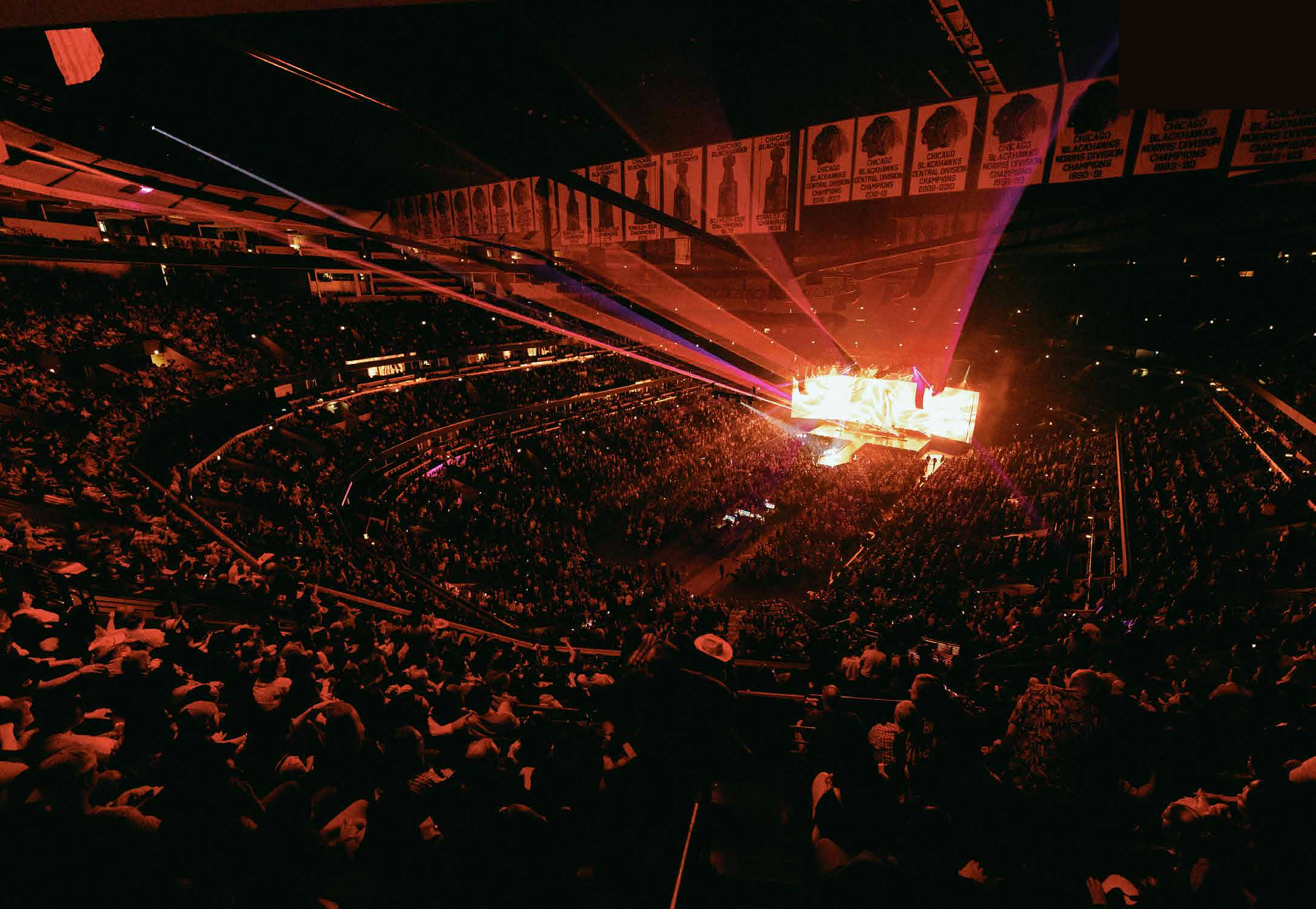

MCR Y1 SELLOUT PROOF IMAGE

31,750 fans. Nissan Stadium. March 2025.

[Insert: Wide-angle crowd shot showing stadium capacity, stage visible, evening lighting]

Market Expansion Timeline

| Year | Market | Status | Investment |

|---|---|---|---|

| 2025 | Nashville | LIVE | Operational |

| 2026 | Nashville Growth | Planned | $3M |

| 2027 | Charlotte | CONFIRMED NEXT | $8M |

| 2028 | Tampa | Pipeline | $8M |

| 2028-29 | New Orleans | Pipeline | $6M |

| 2029+ | Boston | Research | TBD |

Why Charlotte Next (2027)

- 2.7M metro, growing fast

- Country Index: 135 (strong demo)

- NASCAR HQ - audience overlap

- No major rodeo competition

- Spectrum Center (20,000)

MCR Festival: Nashville's CMA Fest for Cowboys

Annual 4-day festival that takes over Nashville like CMA Fest, but for Western/Rodeo culture.

| Element | Description |

|---|---|

| Main Stage Rodeo | PRCA (Professional Rodeo Cowboys Association) Championship, 3 nights |

| Music Stages | 30+ artists over 4 days |

| Carnival/Fair | Midway, rides, family |

| Vendor Village | 200+ Western vendors |

| VIP Experiences | Premium hospitality |

Festival Revenue (Y5)

MCR Unit Economics

Proven Model | Per-Event Profitability | Scalable

Nashville 2025 - Proven Economics

| Metric | Actual Y1 | Y2 Target |

|---|---|---|

| Total Attendance | 31,750 | 45,000 |

| Avg Ticket Price | $185 | $195 |

| F&B Per Cap | $45 | $50 |

| Merch Per Cap | $28 | $32 |

| Revenue Per Attendee | $258 | $277 |

| Total Event Revenue | $8.2M | $12.5M |

Cost Structure

| Venue & Production | 35% |

| Talent (Rodeo + Music) | 25% |

| Marketing | 8% |

| Operations | 12% |

| Operating Margin | 20% |

Multi-Market Projection (Y5)

| Market | Events | Attend. | Revenue |

|---|---|---|---|

| Nashville | 3 | 90K | $25M |

| Charlotte | 2 | 35K | $9M |

| Tampa | 2 | 30K | $8M |

| New Orleans | 1 | 18K | $5M |

| Festival | 1 | 60K | $33M |

| Total Y5 | 9 | 233K | $80M |

Key Unit Economics

Draft House & Hospitality

Titans Partnership | Sports Bar Franchise | McGraw Hotels

Operating Partner Strategy: EMCo does not have in-house restaurant expertise. We are actively exploring partnerships with experienced hospitality operators (Levy Restaurants, Delaware North, or similar) for Draft House operations. Target: LOI with operating partner by Q2 2026. Structure: JV with operator managing F&B operations, TMEH providing brand, location, and programming.

Nashville Flagship

Opening 2027

- Titans stadium zone

- 15,000+ sq ft, 400+ seats

- Country music sports bar

- Live music venue

- Tim McGraw branding

Expansion Markets

Follow MCR Footprint

| Charlotte | 2028+ |

| Tampa | 2029+ |

| Other NFL Zones | TBD |

Co-located with MCR events for maximum synergy.

McGraw Hotels

Y5+ Development

- Nashville Boutique (200-300 rooms)

- Ranch Resort Experience

- Branded floors in partner hotels

- DreamMore Resort model

Hospitality Revenue Projection

| Segment | Y3 | Y5 | Y7 |

|---|---|---|---|

| Draft House Nashville | $0 | $18M | $22M |

| Draft House Charlotte + Tampa | $0 | $12M | $26M |

| MCI Draft House | $0 | $0 | $22M |

| McGraw Hotels | $0 | $10M | $15M |

| Total | $0 | $40M | $85M |

Comparable Unit Economics

| Concept | Rev/SF | Margin | Payback |

|---|---|---|---|

| Topgolf | $450 | 22% | 3.0 yrs |

| Dave & Buster's | $380 | 18% | 3.5 yrs |

| Walk-On's | $420 | 16% | 3.2 yrs |

| Ole Red (Ryman) | $500 | 20% | 2.8 yrs |

| Draft House Target | $520 | 22% | 2.5 yrs |

Source: Industry benchmarks, company filings. Ole Red comparable: 600 Lower Broadway, Nashville.

McGraw NIL & Lifestyle Brand

Name, Image & Likeness (NIL) — Systematic Monetization of 30+ Years of Brand Equity

Current NIL Assets

| McGraw Fragrances (Cologne) | $2-3M/year |

| Music Catalog (partial ownership) | $4-6M/year |

| Touring Brand | Variable |

| 1883/Yellowstone Association | Brand value |

Expansion Opportunities

Tier 1: Immediate (Y1-2)

| Expanded Fragrance Line | $5-8M |

| Western Apparel (Wrangler, Boot Barn) | $3-5M |

| Spirits (Whiskey/Bourbon) | $2-4M |

| Boots/Footwear (Tecovas, Ariat) | $1-2M |

Tier 2: Medium-Term (Y2-4)

| Home/Ranch Collection | $2-4M |

| Outdoor/Lifestyle (YETI, Carhartt) | $1-3M |

| Golf/Country Club | $1-2M |

| Automotive (Truck endorsement) | $2-5M |

NIL Revenue Projection

| Year | Fragrance | Apparel | Spirits | Other | Total |

|---|---|---|---|---|---|

| Y1 | $3M | $1M | $0 | $2M | $6M |

| Y2 | $4M | $3M | $2M | $3M | $12M |

| Y3 | $5M | $5M | $4M | $5M | $19M |

| Y5 | $8M | $10M | $8M | $9M | $35M |

| Y7 | $10M | $15M | $12M | $13M | $50M |

MCR Artist Equity Partners

Music City Rodeo Ownership Structure

Artist Partnership Status:

Year 1 (2025) - COMPLETED: Reba McEntire and Jelly Roll as equity partners and headliners. Sold out 31,750 tickets.

Year 2 (2026) - ON SALE NOW: Miranda Lambert, Charley Crockett, Jon Pardi confirmed as headliners.

Structure: Artist partners are specifically for MCR, not the entire TMEH platform. This creates alignment without diluting platform equity.

Tim McGraw

MCR Founder & Lead Partner

- 100M+ records sold

- 49 #1 singles, 3 Grammys

- Film: The Blind Side, 1883

- 30+ year career, authentic brand

- Founded MCR, sold out Y1

Demo: 35-65, core country

Reba McEntire

MCR Year 1 Partner

- 90M records sold

- 35+ #1 hits

- Rodeo heritage (barrel racer)

- The Voice coach visibility

- MCR Year 1 headliner (2025)

Demo: 45+, multigenerational

Jelly Roll

MCR Year 1 Partner

- Hottest artist 2024-25

- Nashville native

- MCR Y1 headliner - sold out

- Authentic street-to-success

- Brings younger demo to rodeo

Demo: 18-35, new fans

Year 2 (2026) Headliners - ON SALE NOW

Miranda Lambert

Country superstar, 3x Grammy winner, authentic rodeo connection

Charley Crockett

Rising outlaw country star, authentic Western sound

Jon Pardi

Neo-traditionalist, "Dirt On My Boots," proven arena draw

Year 2 builds on Y1 sellout momentum with diverse lineup spanning traditional country, outlaw, and mainstream appeal.

Strategic Partner Benefits

Capital + Infrastructure + Expertise = Force Multiplier

We seek partners who bring more than capital. The right partner provides institutional capital, venue access, and operational infrastructure.

What Strategic Partners Bring

- Capital: $300M raise for platform buildout

- Content Distribution: Media/streaming relationships

- Sports Properties: Venue relationships, sponsorships

- Sovereign Capital: Co-investment for Music City Immersive

- Management Expertise: Institutional-level operations

- Exit Optionality: Strategic sale or IPO path

Ideal Partner Profile

- Platform Thinker: Build ecosystem, not one-offs

- Operator-Aligned: Back exceptional operators

- Long-Term: 7-10 year horizon, not quick flip

- Strategic Value: 3-5x returns through integration

- Sports/Entertainment: Cross-platform synergy

Value Creation Through Partnership

| Partner Asset | TMEH Synergy | Value Creation |

|---|---|---|

| Content/Media | Distribution for MCR and Down Home content | Multi-platform reach |

| Sports Properties | Venue access, sponsorships | Draft House locations, MCR venues |

| Sovereign/Institutional Capital | Music City Immersive funding | $50-100M co-investment |

| LP Network | Institutional credibility | Additional capital sources |

| David Ellison (Skydance/Paramount) | Down Home 15% partner | Paramount distribution infrastructure |

Platform Financials

Phased Approach | Core Business First

| Pillar | Y1 | Y3 | Y5 | Y7 | Margin |

|---|---|---|---|---|---|

| PHASE 1: CORE (Immediate Focus) | |||||

| MCR Events (Nashville → 3 markets) | $5M | $18M | $40M | $55M | 15% |

| MCR Festival | $0 | $12M | $25M | $35M | 18% |

| Down Home (1 film greenlit + dev) | $3M | $15M | $35M | $50M | 12% |

| McGraw NIL/Licensing | $8M | $18M | $30M | $40M | 70% |

| EMCo + Catalog | $10M | $14M | $18M | $22M | 25% |

| PHASE 2: EXPANSION (After Core Proven) | |||||

| Draft House (1-2 locations) | $0 | $0 | $18M | $35M | 12% |

| MCR Lifestyle/Merch | $2M | $6M | $12M | $18M | 35% |

| TOTAL REVENUE | $28M | $83M | $178M | $255M | |

Note: MCI ($180M+ potential) is excluded - separate funding, separate timeline. These are core platform projections only.

Platform Revenue Growth (Y1-Y7)

EBITDA Progression (Industry-Realistic Margins)

Industry benchmarks (SEC filings): Live Nation 7-9%, MSG Entertainment 12-15%, Endeavor 15-18%. Our 18% Y7 target achievable with NIL high-margin (70%) contribution.

Scenario Analysis

| Metric | Bear Case | Base Case | Bull Case |

|---|---|---|---|

| Y7 Revenue | $180M | $255M | $320M |

| Y7 EBITDA | $22M (12%) | $46M (18%) | $64M (20%) |

| Exit Multiple | 8x | 10x | 12x |

| Platform Value | $176M | $460M | $768M |

| MOIC (50% stake) | 0.6x | 1.5x | 2.6x |

| Key Assumptions | 2 MCR markets, content delays | 3 markets, 2 Draft House, slate executes | 4 markets, content hits, Broadway success |

Downside Protection: $80-100M hard asset floor (catalog at 16-18x NPS, consistent with evergreen multiples per Royalty Exchange/Billboard). Upside Optionality: MCI excluded from scenarios - additional $180M+ revenue opportunity if funded separately.

$300M Platform Investment

Consolidate | Build | Scale | Acquire

Capital Deployment

| CONSOLIDATION & RESTRUCTURING | |

| Partner Buyouts & Entity Consolidation | $75M |

| McGraw Catalogue Acquisition | $25M |

| CORE PLATFORM BUILD | |

| MCR Events (Nashville → 5 markets) | $40M |

| MCR Festival Development | $20M |

| Down Home Productions (IP Budget) | $35M |

| Draft House (2-3 locations) | $35M |

| McGraw NIL/Licensing Build | $15M |

| INFRASTRUCTURE & GROWTH | |

| Team Build (CFO, Key Hires) | $15M |

| Working Capital/Reserve | $40M |

| TOTAL | $300M |

What Consolidation Unlocks

- Single Entity: All assets under TMEH umbrella

- Clean Cap Table: Previous partners bought out

- Catalogue Ownership: Full control of $80-100M asset

- Operational Efficiency: One management team, one strategy

Acquisition Opportunities

| Publishing Companies | Country music rights |

| Other Catalogues | Complementary artists |

| Regional Rodeos | MCR expansion |

| Related Businesses | Western lifestyle |

MCI (Music City Immersive): Separate $200M+ raise with partners. Concept phase - will need venue partners, Nashville/Titans alignment, and dedicated funding vehicle.

$300M Capital Deployment

Unit Economics by Pillar

| Pillar | Invest | Y5 Rev | EBITDA | Payback |

|---|---|---|---|---|

| MCR Events | $40M | $65M | $9.8M | 4.1 yrs |

| MCR Festival | $20M | $33M | $5.9M | 3.4 yrs |

| Down Home | $35M | $55M | $6.6M | 5.3 yrs |

| Draft House | $35M | $40M | $5.6M | 6.3 yrs |

| NIL + Catalog | $40M | $45M | $29.3M | 1.4 yrs |

| Total | $170M | $238M | $57.2M | 3.0 yrs |

NIL/Catalogue 70% margin drives 24% blended EBITDA margin

Returns: Yield + Appreciation

Infrastructure Investment Model (Not Venture)

Two sources of returns: (1) Annual cash distributions starting Y3, (2) Platform appreciation through operational excellence. No forced exit timeline.

Distribution Policy (Formalized)

| Period | Policy |

|---|---|

| Years 1-2 | Reinvestment period (no distributions) |

| Years 3-4 | 40% of EBITDA available |

| Years 5+ | 50-60% of EBITDA distributed quarterly |

Cumulative Distributions (Y3-Y7):

$35-50M cash returned before any exit

Platform Appreciation Path

| Year | EBITDA | Value (10x) |

|---|---|---|

| Y3 | $8M | $80M |

| Y5 | $27M | $270M |

| Y7 | $46M | $460M |

10x multiple is conservative vs. Opry precedent (17-18x) and Live Nation (15-21x).

Investor Returns Summary (Base Case)

Y3-Y7 (before exit)

$460M platform × 50%

Distributions + exit

Infrastructure-grade returns

No forced exit: Investors receive ongoing yield. Exit at strategic premium when platform matures, not on arbitrary timeline.

Multiple Justification (Public Comps)

Live Nation (LYV)

15.6-21.5x EBITDA

$23B rev, 7-9% margin

Ryman Hospitality (RHP)

$2.3B rev, $758M EBITDA

Nashville native comp

Opry Transaction

17-18x EBITDA

2022 NBCU/Atairos

TMEH at 10-12x is conservative vs. Nashville entertainment asset precedents (17-18x).

IRR Methodology: 12-18% base case includes (1) exit value at 10x Y7 EBITDA ($46M = $460M platform, $230M for 50% stake), (2) annual cash distributions starting Y3 (~40% of EBITDA as yield: $3M Y3 → $18M Y7), and (3) no distributions Y1-2 during buildout. This is patient capital returns - not venture-style home runs.

Comparable M&A Transactions (Verified)

| Transaction | Year | Value | Multiple | Source |

|---|---|---|---|---|

| Opry Entertainment (30% stake) | 2022 | $293M | 17-18x EBITDA | NBCU/Atairos |

| Endeavor (Silver Lake take-private) | 2025 | $13B equity | ~11x EBITDA | SEC Filing |

| WWE/UFC → TKO Group | 2023 | $21.4B combined | 8.8x revenue | Sportico |

| C3 Presents → Live Nation | 2014 | $125M (51%) | ~1x revenue | Billboard |

| TMEH (Implied Y7) | 2033 | $460M-$768M | 10-12x | Base/Bull case |

Opry Entertainment (Nashville native) paid 17-18x EBITDA validates premium for Nashville entertainment assets.

Exit Optionality

Multiple Paths to Premium Returns

Strategic Sale

Most Likely | Y7-10

Premium buyers: Live Nation, Liberty Media, Endeavor, Disney, or private equity.

| Valuation | $2-3B+ |

| Premium | 20-40% strategic |

| Timeline | Y7-10 |

IPO / Public Markets

Alternative | Y8+ (Cautious)

Public markets may undervalue entertainment assets.

| Endeavor IPO ($24) → Take-Private ($27.50) | Limited upside |

| SPAC entertainment deals | -59 to -75% avg |

| Strategic sale preferred | Premium exit |

Asset Spin-Offs

Value Unlock | Ongoing

Sell individual pillars at premium multiples.

| Music City Immersive | $1B+ standalone |

| Down Home | $200-400M |

| Draft House chain | $150-300M |

Dividend Recaps

Interim Returns | Y4+

Debt capacity enables distributions while holding equity.

| Y5 Debt Capacity | $150M+ |

| Distribution | 0.5x+ early |

| Retain upside | Full ownership |

Bottom Line: Multiple paths to 3-5x+ returns over 7-10 year hold period.

Risk Factors & Mitigations

Honest Assessment | Proactive Solutions

| Risk | Description | Mitigation |

|---|---|---|

| Tim McGraw Dependency | Platform relies heavily on Tim's brand and involvement | Key Person Protections: $50M insurance (life + disability). 7-year commitment (100 days/year min). MCR partners share burden. Platform designed to outlive founder. Succession planning Year 5. |

| Execution Complexity | 6 pillars require simultaneous execution | Phased rollout (MCR first, Draft House 2027, Immersive 2029). Strategic partner operational support. |

| Music City Immersive Capex | $200M is a significant separate raise | Titans/Nashville as anchor partner. Mubadala connection. Not dependent on $300M. |

| Country Music Trends | Genre popularity could shift | Cross-genre appeal (Jelly Roll). Nashville tourism is growing regardless. Immersive is music-agnostic. |

| Competition | Live Nation or others could enter | First mover advantage. Artist relationships are non-replicable. 3-5 year head start. |

| Economic Downturn | Consumer discretionary spending falls | Historical data (BLS): Entertainment spending dropped only 12.4% in 2008-09 recession. Music catalogs show negative market correlation (beta -0.65). Country audiences historically resilient. |

Key Insight

The biggest risk is not doing this. Tim McGraw's brand value peaks in the next 10 years.

Without systematic monetization, the opportunity is lost forever.

Governance & Leadership

Professional Structure | Artist-Led Vision

Board Structure (7 Members)

| Seat | Representative |

|---|---|

| Chairman | Tim McGraw |

| CEO (Board Seat) | Scott Siman |

| Vice Chairman | Strategic Partner Designee |

| Investor Designee | Lead Investor Representative |

| Independent #1 | Entertainment Executive |

| Independent #2 | Finance/Audit Expert |

| Independent #3 | Nashville Community |

Note: MCR Artist Partners (Reba, Jelly Roll) have MCR-specific governance, not TMEH board seats.

Operating Leadership

| Role | Name |

|---|---|

| CEO | Scott Siman |

| President, EMCo | Scott Siman |

| Co-Founder, MCR/Down Home | Brian Kaplan |

| Leadership | Kelly Clague |

| CFO | To be hired post-close |

Scott Siman: 25+ years music industry. Tim McGraw's manager. EMCo President.

Ownership Structure (Illustrative)

Board Committees

Audit

Independent chair + Strategic Partner rep. Quarterly financial reviews, controls oversight.

Compensation

Independent chair. Executive comp, LTIP, artist incentives.

Strategy & ESG

Tim chair. M&A, major investments, sustainability, community initiatives.

Formal Distribution Policy

Board-Mandated Cash Returns — Not discretionary, contractually committed

Building infrastructure

Cash flow begins

Mature distributions

Returned before exit

Yield + Appreciation model: Investors receive cash returns throughout hold period, not dependent on exit.

ESG Commitments

- Environmental: LEED-certified locations. Carbon-neutral events Y5.

- Social: Nashville community fund (1% revenue). Youth music programs.

- Governance: Independent audit. Quarterly reporting. Big 4 auditor.

Continuity & Succession

- Key Person Insurance: $50M on Tim McGraw (life + disability)

- Tim's Commitment: 7-year term, 100 days/year minimum

- Succession Plan: Developed by Y5; Tim to Chairman Emeritus Y7+

- Brand Continuity: Platform assets operate beyond any individual

*Structure subject to negotiation. Key: Tim maintains creative control, strategic partner has governance rights, platform designed to outlive founder.

Catalog & IP Ownership

Transparency on Tim McGraw's Music Assets

Investor Transparency: We acknowledge questions about catalog ownership and provide clarity below. Full IP audit and chain-of-title verification will be completed prior to close with seller indemnity provisions.

What Tim McGraw Owns

| Publishing Rights (EMCo) | Majority ownership |

| Post-2012 Master Recordings | Full ownership |

| Name, Image & Likeness | Full ownership |

| Digital Distribution | Current agreements |

| Neighboring Rights (Int'l) | Registered collections |

Items Requiring Verification

| Pre-2012 Masters (Curb era) | Settlement-governed |

| Publishing Splits (Sony/ATV) | To be audited |

| Faith Hill Rights | Separate ownership |

| Sync Licensing Terms | Varies by track |

Curb Records History (Addressed)

Background: Tim was in litigation with Curb Records (2011-2012) regarding contract terms and master ownership. Settlement was reached, terms are confidential but govern the status of early catalog masters.

Due Diligence Action: Prior to close, outside counsel will complete full chain-of-title audit on all masters. Transaction will include seller indemnity for any pre-settlement title issues.

Catalog Valuation Methodology

Conservative floor estimate

Industry standard evergreen

Net Publisher Share

For remaining rights

Valuation methodology consistent with Royalty Exchange/Billboard 2024 evergreen catalog multiples. Independent valuation to be conducted by qualified music IP appraiser prior to close.

Execution Timeline

Phased Deployment | Milestone-Gated Capital

- Close $300M investment, deploy $100M

- Entity consolidation + CEO/CFO hired

- MCR Nashville Y2 (grow attendance 30%)

- NIL licensing deals signed (fragrance, apparel)

- Down Home development slate

GATE: Revenue $50M+ | Team in place | MCR profitable

- MCR Charlotte launch + Festival

- Draft House Nashville opens (Titans stadium)

- First Down Home production greenlit

- MCI concept exploration (if viable)

GATE: Revenue $150M+ | 2 markets profitable | Down Home greenlit

- MCR markets 3-5 (Tampa, New Orleans, Dallas)

- Draft House locations 2-3

- Broadway musical development

- MCI development (if concept validated + funded)

- Exit optionality evaluation

GATE: Revenue $350M+ | EBITDA 25%+ | Exit ready

Milestone-Gated Capital Deployment

Not all $300M released Day 1. Capital tranches tied to gate achievements. Investor protection on underperformance. Board approval required for next phase deployment.

Key Performance Indicators (Milestone Triggers)

| KPI | Y1 Target | Y3 Target | Y5 Target | Y7 Target |

|---|---|---|---|---|

| MCR Markets | 1 (Nashville) | 2 (+ Charlotte) | 4 | 5+ |

| Revenue (Core Platform) | $28M | $83M | $178M | $255M |

| Revenue (with MCI)* | - | - | - | $535M+ |

| EBITDA Margin | 0% | 18% | 22% | 25% |

| NIL Licensing Deals | 3 | 8 | 15+ | 25+ |

| Down Home Productions | 1 GREENLIT + 5 dev | 4+ greenlit | 6+ released | 12+ |

*Milestone achievements may trigger capital deployment tranches and governance thresholds. Details subject to definitive agreements.

Why Nashville. Why Now.

Record-Breaking Growth | Verified 2024 Data

Nashville Market Strength

| 2024 Visitor Spending Growth | +4.17% YoY |

| Recreation Spending | $2.49B (22%) |

| Food & Beverage | $2.52B (23%) |

| Tax Revenue Generated | $1.16B |

| Projected 2027 Visitors | 18.1M |

| Projected 2033 Visitors | 20M+ |

Source: Nashville CVB / Tourism Economics

What Nashville Doesn't Have

- No immersive music destination

- No Area 15 or Sphere equivalent

- No technology-forward music experience

- No year-round indoor music attraction

- No premium cowboy culture event

- No Tim McGraw Experience

16.9 million tourists spend $11.2 billion in Nashville.

Titans Stadium + East Bank = 550 acres, $3B+ development catalyst.

Competitive Landscape

No One Else Can Build This

| Competitor | What They Have | What They're Missing |

|---|---|---|

| Live Nation | Venues, ticketing, tours | No artist ownership, no immersive, no Nashville focus |

| MSG/Sphere | Immersive technology, venues | No artist relationships, no country music focus, no Nashville |

| Dolly Parton / Dollywood | Theme park, brand, hospitality | Different category (family theme park), not replicable |

| Endeavor | Talent, events, content | No country music focus, no immersive, no venue ownership |

| Meow Wolf / Area 15 | Immersive entertainment | No music focus, no artist partnerships, no Nashville |

| Ryman Hospitality (RHP) | $2.3B rev, Opry, Ryman, Ole Red ($183M) | Potential partner or acquirer; validates Nashville entertainment value at 17-18x EBITDA |

The TMEH Advantage

Artist Ownership

Non-replicable

Nashville Location

Music City

First Mover

3-5 year head start

Platform Integration

6 pillars, 1 ecosystem

Leadership & Team

Experienced Operators | Iconic Artists | Strategic Capital

Tim McGraw

Founder & Chairman

- 100M+ records sold

- 49 #1 singles, 3 Grammys

- Film: The Blind Side, 1883

- EMCo Management founder

Scott Siman

Chief Executive Officer

- 25+ years music industry

- Tim McGraw's manager

- EMCo founding President

- Operations & strategy

Al Hagaman

Chief Financial Officer

- Financial leadership

- Capital strategy

- Platform economics

- Investor relations

Kelly Clague

President

- Platform operations

- Strategic execution

- Business development

- Partnership oversight

Brian Kaplan

Chief Creative Officer

Platform co-architect. Music City Rodeo co-founder. Down Home co-founder. Immersive & content development lead.

David Ellison

Down Home Board Member

CEO, Paramount/Skydance. 15% owner, Down Home. Content distribution infrastructure.

Executive Team Confirmed

CEO: Scott Siman | CFO: Al Hagaman | President: Kelly Clague | CCO: Brian Kaplan

Full C-suite in place. Professional management team ready to execute.

Investment Terms

Indicative Structure

Capital Structure

| Investment Amount | $300M |

| Instrument | Preferred Equity |

| Investor Ownership | ~50% (negotiable) |

| Liquidation Preference | 1.0x participating |

| Board Seats | 2 of 7 |

| Protective Provisions | Standard |

Key Terms

| Valuation (Pre-Money) | $300M (1x entry) |

| Use of Proceeds | Per deployment plan |

| Tim McGraw Commitment | 7-year minimum |

| Management Incentives | 5% equity pool |

| Reporting | Quarterly board + monthly ops |

| Exit Horizon | 7-10 years |

Investor Protections

Anti-Dilution

Weighted average ratchet

Drag-Along

For qualified exits

Tag-Along

Pro rata participation

*Terms indicative only. Subject to negotiation and documentation.

Due Diligence Access

Available Upon Request

Financial

- MCR historical financials (2024)

- EMCo management accounts

- Pro forma financial model

- Tax structure analysis

- Entity org charts

Legal

- Tim McGraw NIL agreements

- MCR venue contracts

- Draft House / Titans LOI

- Content/IP ownership

- Insurance and liability

Operational

- MCR Y1 attendance data

- Sponsor pipeline

- Artist relationship matrix

- Market research (Charlotte, etc.)

- Competitive analysis

Next Steps

Phase 1: Information

- Sign NDA

- Data room access

- Management presentations

Phase 2: Diligence

- Site visits (Nashville, MCR)

- Management interviews

- Third-party reports

The Ask

Partner With Us to Build an Icon

We're not asking you to bet on a rodeo.

We're asking you to help build the Dolly Parton model for the next generation.

Down Home Entertainment. Music City Rodeo. The McGraw Brand.

A $460M+ base case platform with significant upside optionality.

Music City Immersive ($200M) will be a separate capital raise with strategic partners (Titans/Nashville, MSG, Live Nation, or Mubadala). This $300M builds the platform that makes Immersive possible.

Why Partner With Us

A Rare Platform Opportunity

What We Offer Partners

- Irreplaceable Brand: Tim McGraw, 100M+ records, 30-year legacy

- Proven Execution: MCR Year 1 sellout (31,750 tickets)

- Content Pipeline: Skydance/Paramount distribution via Down Home

- Nashville Market: 17M tourists, $2.1B stadium, structural growth

- Platform Diversification: 6 pillars, multiple revenue streams

- Downside Protection: $80-100M music catalog floor

What We Seek in Partners

- Patient Capital: 7-10 year horizon

- Sports/Entertainment Expertise: Venue operations, sponsorships

- Content Knowledge: Media/distribution relationships

- Sovereign/Institutional Access: Co-investment for Immersive

- Operational Support: Not passive money

- Nashville Alignment: Long-term commitment to Nashville

This is not just an investment. This is a chance to build the next Nashville institution.

The right partner becomes part of something that outlasts us all.

The Vision

Music + Content + Live Events + Hospitality + Immersive + Licensing

=

The Tim McGraw Platform

MCI adds $180M+ revenue potential if validated and funded separately ($200M+ raise with strategic partners)

Important Disclosures

Forward-Looking Statements & Risk Factors

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include projections of revenue, EBITDA, and enterprise value. Such statements are based on current expectations and involve risks, uncertainties, and assumptions that could cause actual results to differ materially from those projected.

Material Assumptions

Projections assume: successful consolidation of existing entities; timely completion of venue development; continued growth in country music and western lifestyle markets; no material adverse changes in the Nashville entertainment landscape; execution of planned strategic partnerships; and availability of qualified management.

Investment Risks

- Key person dependency on Tim McGraw

- Market conditions affecting live entertainment

- Construction and development risks for MCI

- Competition from established entertainment companies

- Artist partnership execution risk

- General economic conditions affecting consumer spending

Not an Offer

This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any offering will be made only by means of a confidential private placement memorandum to qualified investors.

CONFIDENTIAL

This document contains proprietary information and is intended solely for the recipient. Do not distribute, reproduce, or share without express written permission from TMEH.

DATA SOURCES

Nashville tourism: Tennessee Hospitality & Tourism Association, 2024 | Country streaming growth: MRC Data/Luminate 2024 | PBR valuation: Endeavor/Silver Lake transaction Oct 2024 | Catalog multiples: Billboard, Hipgnosis Songs Fund 2024 | Tim McGraw records: RIAA certifications | Box office data: Box Office Mojo | Dolly Parton empire: Forbes estimates 2024 | Titans stadium: Metro Nashville Development Authority

Tim McGraw Entertainment Holdings

Building the Future of Country Music Entertainment

Contact

Tim McGraw

Founder & Chairman

Scott Siman

CEO, EMCo Management

EMCo Management

Nashville, Tennessee

Confidential | January 2026